Search Engine Land » PPC » Amazon holiday shopping outlook: A guide for advertisers

Amazon holiday shopping outlook: A guide for advertisers

Amazon marketers should look into 2021 data as soon as possible to get a sense of when to hit the gas on advertising this year.

Andy Taylor on November 4, 2022 at 10:27 am | Reading time: 8 minutes

With Amazon’s October Prime Early Access Sale in the books, Amazon advertisers need to fine-tune their strategy for the core stretch of Q4.

Part of that planning revolves around:

- Mapping out how budgets will be spent over the final month and a half of the year.

- Which days to push the pedal most on.

We dug deep into the more than $400 million in Amazon ad spend under management annually at Tinuiti (my employer) to:

- Quantify what we’ve seen in the past and better estimate what might happen this go around.

- Help brands better understand how performance for Amazon ads shifts over the course of the holiday shopping season.

Let’s dive in.

Looking back at the 2020 vs. 2021 holiday seasons

It may be tough to remember at this point, but way back in 2020 the holiday shopping season looked very different than any previous year for Amazon vendors and sellers.

First, there was the Oct. 13-14, 2020 Prime Day event, which was delayed from its typical mid-year timing. As a result of the surge in ecommerce demand pushing Amazon’s fulfillment capabilities to the limits in the early months of the pandemic, the change created a new Q4 “holiday.”

The sales per click of sponsored products ads soared relative to what would typically be expected in the middle of October. We saw a sequel of this with the Prime Early Access Sale this year.

Much of Amazon’s and other retailers’ efforts to kickstart the Q4 2020 shopping season earlier than usual were intended to pull demand earlier in the quarter as:

- Shipping delays were causing huge headaches at the time.

- Last-minute shoppers wouldn’t be able to reliably get packages as quickly late in the season.

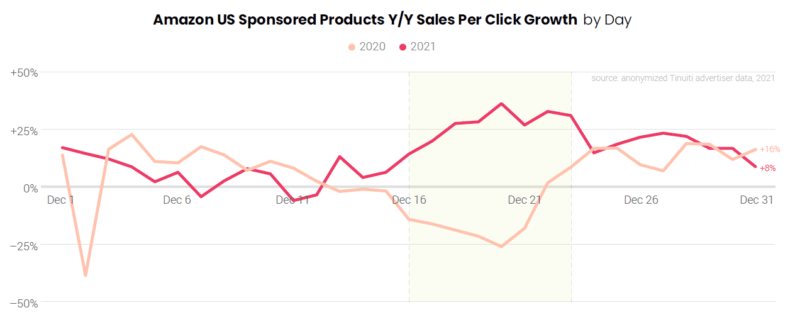

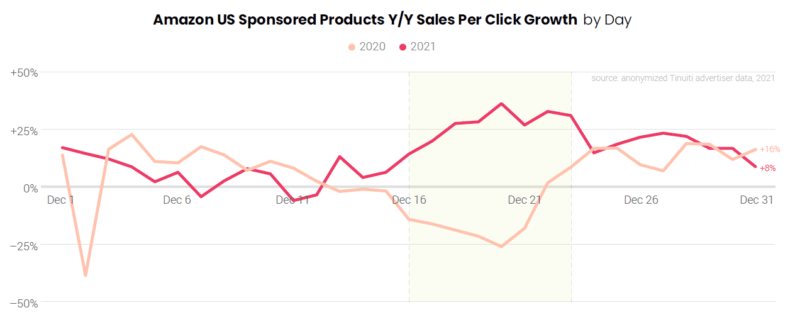

This also led to much earlier shipping cutoff dates in order to get packages in time for Christmas, and our second key divergence for Q4 2020 ad performance compared to other years – a meaningful drop in sales per click in the third week of December compared to 2019.

By 2021, shipping delays were much less obstructive than in 2020, and cutoff dates to receive packages in time for Christmas returned to a more typical schedule.

In turn, advertisers saw sales per click in the third week of December soar relative to 2020, the exact opposite of the trend a year prior.

Looking ahead to this year’s holiday season, we expect shipping cutoffs to be more in line with 2021 than 2020, such that advertisers should see the sales per click of ads hold up later in the shopping season.

Now, let’s take a look at how total sales volume trended on key days during the holiday season last year.

Black Friday and Cyber Monday are tops in volume for most brands

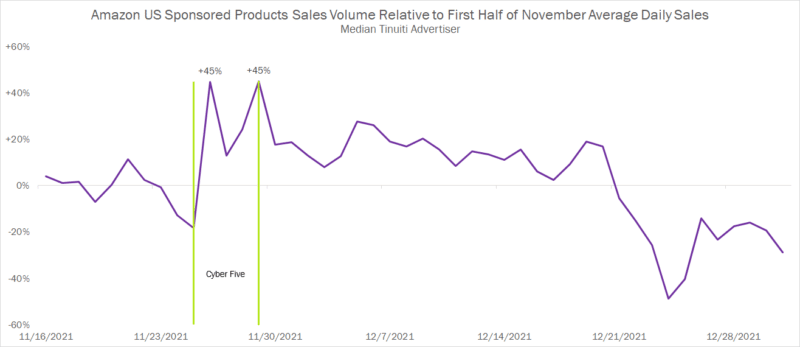

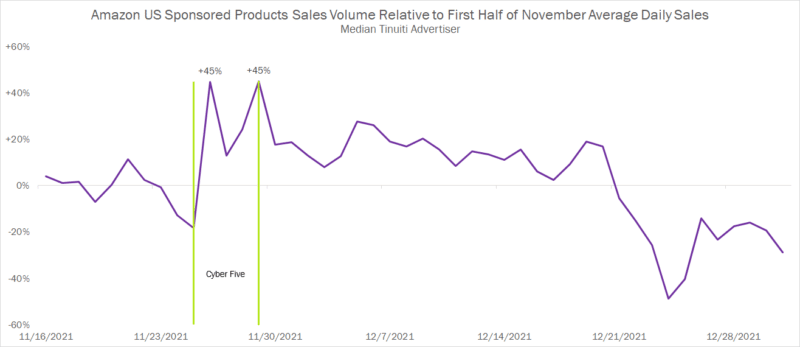

When it comes to the sheer volume of sales attributed to ads during the holiday shopping season, Black Friday and Cyber Monday (BFCM) continue to be pivotal parts of overall success.

In 2021, the median advertiser saw sales attributed to Sponsored Products ads rise 45% on both Black Friday and Cyber Monday compared to average daily sales for the first half of November.

While we’re using median here to convey how big these two days are for middle-of-the-pack advertisers, the surge in sales was certainly much larger for some brands than others.

35% of sponsored products advertisers saw Black Friday sales more than double compared to the first half of November, and 37% saw the same for Cyber Monday.

In terms of pure volume, no other day between mid-November and late December comes close to the sales attributed to ads on BFCM for most brands.

It’s possible that the Prime Early Access Sale in October pulled forward some of the volume that would otherwise happen in November and December.

That said, it’s unclear how that might play out in terms of impacting specific days. It’s very likely we’ll still see Black Friday and Cyber Monday come out on top compared to other days over the last month and a half of the year.

However, total sales volume is only one measure of the opportunity available to brands. Sales-per-click trends show how incredibly valuable other days can be as well.

Get the daily newsletter search marketers rely on.

<input type="hidden" name="utmMedium" value="” />

<input type="hidden" name="utmCampaign" value="” />

<input type="hidden" name="utmSource" value="” />

<input type="hidden" name="utmContent" value="” />

<input type="hidden" name="pageLink" value="” />

<input type="hidden" name="ipAddress" value="” />

Processing…Please wait.

The value of ad clicks in late December last year neared Cyber Monday highs

Consumers are certainly ready to convert when it comes to sales holidays like Cyber Monday and Black Friday.

But urgency also builds toward the end of the season, when consumers are down to the wire and need gifts in time for Christmas and other holidays.

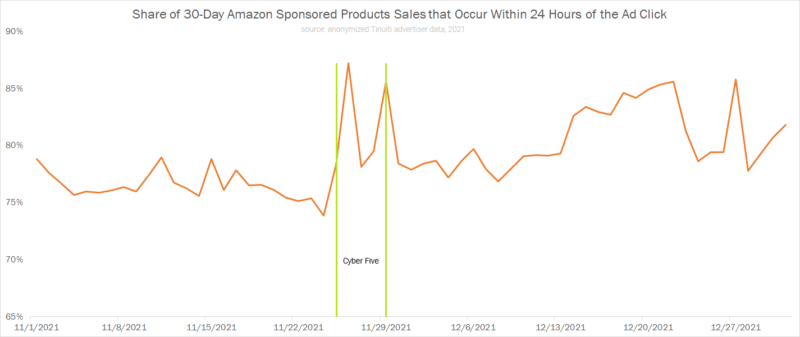

This is clear when looking at the share of total sales attributed to sponsored products using a 30-day window that occurred within the first 24 hours of the ad click. This can be used as an indicator of how compelled shoppers felt to convert at any given time.

As you can see, the share of purchases that occurred quickly after an ad click went up significantly on Black Friday and Cyber Monday, falling thereafter before rising throughout the rest of the shopping season until shipping cutoffs for Christmas delivery came into effect.

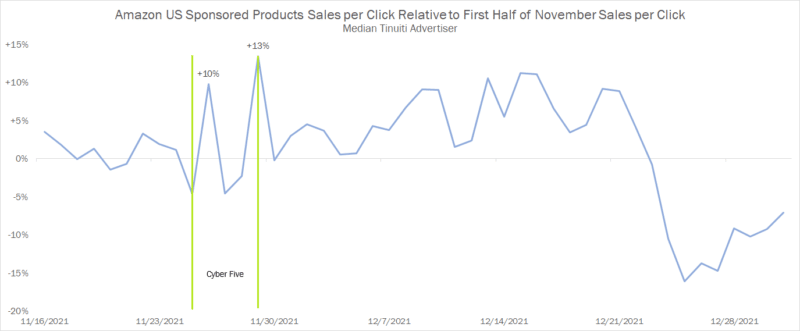

A similar trend unfolds when looking at how sales per click changed over the course of the holiday season last year.

The value of ad clicks peaked on Cyber Monday for the median advertiser, but several days in late December neared this high as the value of ad clicks rose with shoppers’ sense of urgency.

But here’s the catch! Some of the conversions that are attributed to ads on BFCM or to days just before the shipping cutoff can be partially attributed to marketing efforts that occurred before those key stretches.

For example, search formats like sponsored products often get a boost in performance from display campaigns that build awareness on and off Amazon prior to the final ad interaction and conversion.

When evaluating opportunity, advertisers need to look beyond simple volume metrics to guide strategy, especially in setting bid adjustments to account for changes in the expected value of ad clicks.

But they also need to understand that boosts in sales per click on any given day might be the result of ad interactions on other days that weren’t credited with the sale.

Given different kinds of shoppers carry different lifetime values, brands should also look beyond just the direct sales per click in assessing how much shoppers are worth during different periods of the holiday shopping season. New-to-brand metrics can help advertisers do just that.

New-to-brand customers offer another incentive for brands to be aggressive on big days

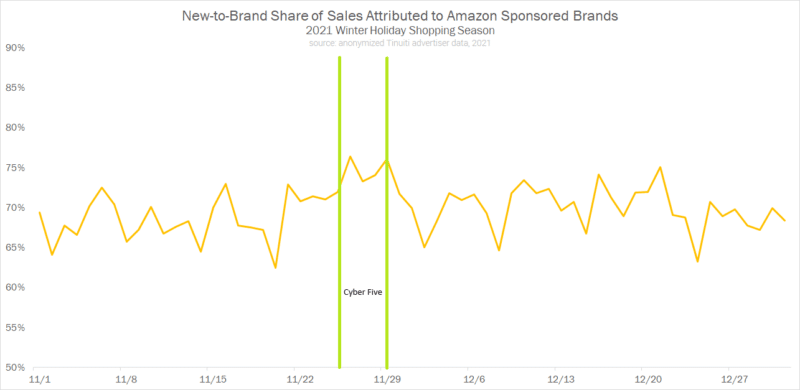

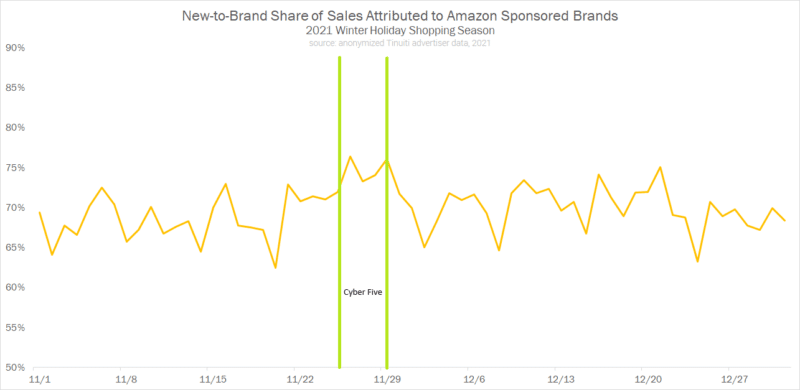

New-to-brand sales, defined by Amazon as those sales that come from customers who have not purchased from a brand in at least a year, allow advertisers to get a better sense of what kinds of customers their sponsored brands and Amazon demand-side platform (DSP) campaigns are attracting.

Looking at the share of total sales attributed to sponsored brands that came from new-to-brand customers during the holiday shopping season last year, advertisers found the highest share days between the beginning of November and the end of the year came on Black Friday and Cyber Monday, which both saw 76% of sales attributed as new to brand.

A close third place went to Dec. 21 at 75% new-to-brand share, as shoppers appeared more willing to purchase from new brands as they secured last-minute gifts.

New-to-brand share was the lowest (62%) during the last two months of the year on Nov. 20, the Saturday before Thanksgiving.

These trends vary by the advertiser, and swings can be much more significant for some brands than others.

Looking at how new-to-brand share has trended during past holiday seasons should help inform when brands should adjust strategy this go around.

Holiday sales takeaways for Amazon advertisers

There are a lot of unknowns heading into the holiday shopping season in 2022, especially regarding how well the economy as a whole will hold up.

Even so, brands should still understand how recent performance has trended during the core weeks of Q4 in the past. 2021 is likely a decent indicator of how different days will compare to one another in 2022.

Key days like Cyber Monday and Black Friday still play a meaningful role, with sales volume for these two days far eclipsing that of other days during the holiday shopping season.

As such, brands should have a strategy in place for making the most of the surge in shopping intent that comes with these sales holidays.

That said, advertisers can find gold in the form of higher sales per click and elevated new-to-brand customer share at other points in Q4.

Amazon marketers should look into 2021 data as soon as possible to get a sense of when to hit the gas on advertising.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Add Search Engine Land to your Google News feed.![]()